Are you a student in Nigeria and want to apply for the Tinubu student loan (NELFUND Student Loan)? If yes then you are in the right place! This article covers everything you would love to know about the loan.

Additionally, we will be taking you through the step-by-step guide on how you can apply for this loan successfully. We kindly advise you to follow the article to the end so that you will not miss any important information.

About Tinubu Student Loan

The Federal Government Student Loan Initiatives, commonly referred to as the Tinubu Student Loan, is a program established by the Nigerian Federal Government to help students in higher education institutions address their financial challenges.

This initiative was signed into law on Wednesday, April 3, by President Bola Ahmed Tinubu following the Student Loans (Access to Higher Education) Act (Repeal and Re-Enactment) Bill, 2024.

The program is aimed at revolutionizing higher education accessibility in Nigeria by providing interest-free loans to eligible students, to help them meet up with their financial needs and challenges, fundamentally reshaping the educational landscape.

According to Mr. President, education is a powerful tool to fight against poverty and as such, should be given all the proper attention it deserves, for the development of the country. He said that the student loan initiative is here to empower students and to make sure that no student, regardless of their background, is excluded or denied the right to quality education and opportunity to build his/her future.

The loan (which is currently running) is targeted to cover about 1.2 million students in federal tertiary institutions across the country. These include federal government-owned universities, polytechnics, colleges of education, and technical colleges. It’s not currently available for other institutions.

Read Also: Loan Apps in Nigeria: Compare, Choose, and Apply

Who is Qualified For This Loan

- Students of the federal government tertiary institutions who have not defaulted in respect of any previous loan granted by any licensed financial institution.

- Students who are not found guilty of any form of malpractice or misconduct by any school authority.

- Students who are not convicted of fraud and forgery, drug offenses, cultism, felony, or any offenses involving dishonesty.

Eligibility Requirements

Below are the eligibility requirements for Federal Government Student Loan in Nigeria:

- You Must be a citizen of Nigeria.

- You must be an active student of a federal government tertiary institution.

- You must provide your National Identification Number.

- You must provide your Jamb admission letter and student ID card (optional).

- You must have a valid BVN (Bank Verification Number) and an active bank account with any domestic bank in Nigeria.

- You must have a valid Jamb record.

- You must have an active email.

Tinubu Student Loan Amount

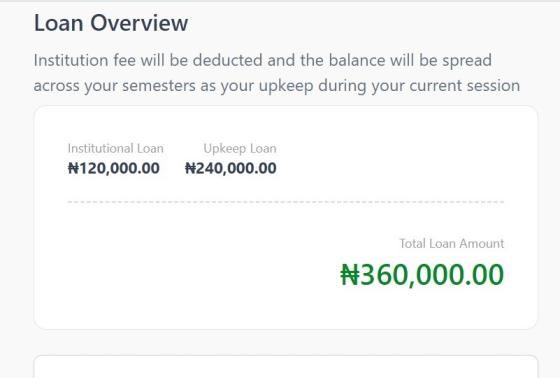

The loan amount is not fixed. I have seen several applicants with different loan amounts. This all depends on your institution and your institutional fees. Note that the loan is categorized into 2; Institutional Loan and Upkeep Loan.

Do You Know?

- We offer expert financial advisor services that can help you achieve your goals.

- We help individuals gain financial freedom.

- We mentor individuals to become successful entrepreneurs.

- We coach or mentor individuals in various digital skills (such as Cybersecurity, Web Design and Development, content creation, Mobile App Development, Data Analysis and Data Science, Digital Marketing, etc).

In case you don’t know, the loan provision is designed to cover in its entirety the student’s obligatory institutional fee as provided by their institution. If the upkeep loan is selected, a monthly stipend of N20,000 will be paid to the student account for a period of 12 months. The total amount received through this upkeep loan over the year will be N240,000 (N20,000 x 12).

For instance, if your institutional fee is N120,000, your loan amount will be N360,000, which includes N120,000 for the institutional fee and N240,000 for the upkeep loan. Check the photo below.

Read Also: Top 8 Loan Apps Without BVN in Nigeria

Loan Tenure

Repayment of the loan is due two years after the completion of the National Youth Service Corps (NYSC).

Interest Rate

The loan is completely interest-free and there are no hidden charges.

Tinubu Student Loan Portal

The portal for The Federal Government Student Loan Initiatives (Tinubu Student Loan) is https://nelf.gov.ng/.

How to Apply For Tinubu Student Loan (NELFUND Student Loan) in Nigeria

To apply for Tinubu student loan (NELFUND Student Loan), follow the steps below:

- Visit the loan application portal (https://nelf.gov.ng/).

- Click the Apply Now button.

- A welcome page will be open for you. Click the Get Started button below to proceed.

- Select Yes, I am a Nigerian, and verify your educational information by selecting your institution and providing your matric number. The system will automatically verify your information. Click Continue to move on.

- In step 3, you will be required to verify your student status. Click Verify With JAMB, enter your JAMB registration number and date of birth, and proceed by clicking Verify JAMB Profile.

- On the next screen, enter the required information to create your account. These include your NIN (National Identification Number), an active email, and password. A confirmation email will be sent to you to verify your account. Simply open the email and verify.

- Congratulation! You have now created your account. Now it’s time to complete your profile. Simply follow the steps and provide the required information to complete your profile creation.

- Finally, a loan page will be open for you to apply for your loan. If done successfully, a congratulatory message will pop up on the screen containing your tracking ID. Please keep it safe in case you need to monitor the status of your loan application in the future.

Read Also: Education Loan in Nigeria: How to Apply & All You Need to Know

Tinubu Student Loan (NELFUND Student Loan): Final Thoughts

Thank you for following this article to the end! I believe that by now you have clearly understood everything you need to know about Federal Government Student Loan Initiatives (Tinubu Student Loan) and can now apply without stress.

In conclusion, this initiative is designed to empower students of federal tertiary institutions to meet up with their financial needs or challenges. It’s no doubt, one of the best options for any student looking for a loan to finance his or her education.

One good thing about the loan is that it’s an interest-free loan and the loan tenure is very convenient (2 years after the completion of the National Youth Service Corps).

Now let’s hear from you!

What do you have to say about this loan? Is it a welcome development for you?

You can use the comment section below to share your thoughts or ask questions.

Pingback: Student Loans in Nigeria: Best Loan Offers And How to Apply | INSTANTMONI