Are you looking for the EZ Cash Loan by Stanbic IBTC? If your answer is yes then you are on the right page, continue reading!

This post discusses everything you need to know about the EZ Cash Loan including the appreciation process, requirements, interest rate, and other important information about the loan.

We kindly advise you to read to the end so that you will not miss any important information.

About Stanbic IBTC

Stanbic IBTC Holdings, in short, Stanbic IBTC, is a popular financial service holding company in Nigeria. The acronym “IBTC” originally stood for Investment Banking and Trust Company, reflecting its initial focus on investment banking activities.

This financial institution was established in 1989 and since then, has carved a niche for itself, catering to both individuals and businesses seeking robust financial solutions.

The bank is a member of the Standard Bank Group, one of the largest financial services providers based in South Africa.

Their headquarters is located at Stanbic IBTC Towers, Walter Carrington Crescent, Victoria Island, Lagos State, Nigeria.

Without a doubt, Stanbic IBTC Holdings is recognized as a key player in financial inclusion. They are poised to take banking to the doorsteps of customers in other to satisfy their daily financial needs.

With Stanbic IBTC, users can open current, savings, and domicially accounts. They can also enjoy other categories of financial services like vehicle and asset finance, MasterCard debit cards, and Visa credit cards.

Stanbic IBTC is also a popular player when it comes to loans. They tend to be the favorite choice for many individuals looking forward to accessing a loan from domestic banks in Nigeria.

Do You Know?

- We offer expert financial advisor services that can help you achieve your goals.

- We help individuals gain financial freedom.

- We mentor individuals to become successful entrepreneurs.

- We coach or mentor individuals in various digital skills (such as Cybersecurity, Web Design and Development, content creation, Mobile App Development, Data Analysis and Data Science, Digital Marketing, etc).

They offer different types of loans including personal loans, home loans, small and medium-scale enterprise (SME) loans, salary advance loans, vehicle and asset finance, secured and unsecured loans, and specialized mortgages for pension contributors.

Their loans are designed for both individuals and businesses looking for convenient loans to attend to their financial challenges.

In this article, we will focus on and discuss one of their popular loan product called the EZ Cash Loan. Follow me as I explore the Stanbic IBTC EZ Cash Loan!

Also Check: A Must Check: Full List of Loan Apps Approved by CBN & FCCPC

About EZ Cash Loan

EZ Cash Loan is an easy-to-go and convenient loan product offered by Stanbic IBTC Holdings.

This loan offer is designed to support the financial needs of individuals and businesses to aid their development.

With the Stanbic IBTC EZ Cash Loan, you can borrow from N20,000 to N4 Million. The repayment term ranges between 1 to 12 months. No collateral and no documentation is needed to access the loan.

One good thing about this loan offer is that you can apply and receive your loan in minutes, once approved, making it a good option for anyone looking for an instant loan in Nigeria.

Also, pre-liquidation is allowed without penalty and repayments are automatically made at your convenience or chosen time.

Additionally, you have the flexibility to borrow funds multiple times. However, the total amount you can borrow cannot exceed your maximum assigned limit.

EZ Cash Loan Interest Rate

The applicable interest rate for EZ Cash Loan is 2.5% monthly.

For instance, if you borrow N100,000, and choose a replacement plan of 6 months, your total repayment amount plus the interest rate will be N115,000.

If you decide to choose a longer repayment plan, maybe 12 months, your total repayment amount plus the interest rate will be N130,000.

Also Check: Loans For Startup Business in Nigeria: How to Apply & More

How to qualify for Stanbic IBTC EZ Cash Loan

Just like any other loan, there are certain eligibility requirements you must meet to qualify for this loan product.

These requirements are set to maintain a good borrowing environment and to avoid lending to high-risk borrowers.

Without wasting time, below is the list of what you need to qualify for the EZ Cash Loan:

- Borrowers must have an active Stanbic IBTC account that is at least 6 months old.

- You must be at least 18 years old and not more than 59 years old at the time of application.

- Users with any history of dud cheques are not qualified.

- You must have satisfactory or good credit reports.

Once you meet the above requirements, you are qualified to enjoy the Stanbic IBTC EZ Cash Loan. However, your loan limit depends on your average monthly income and your credit scores.

EZ Cash Loan Application

The application process for this loan is very straightforward. Stanbic IBTC employs all the necessary channels powered by sophisticated technology to bring easy-to-go and convenient banking services to customers.

There are three major ways to apply for EZ Cash Loan;

- Using a USSD code.

- Via their Internet banking platform OR

- Through their mobile app.

How to Apply Using USSD code

To apply for the loan using a USSD code, dial *909*44# and follow the prompt. Make sure you dial it with the phone number linked to your Stanbic IBTC account.

How to Apply Via their Internet banking platform

To apply for the loan via their Internet banking platform, visit www.stanbicibtcbank.com, navigate to their loans section, and select the EZCash loan option.

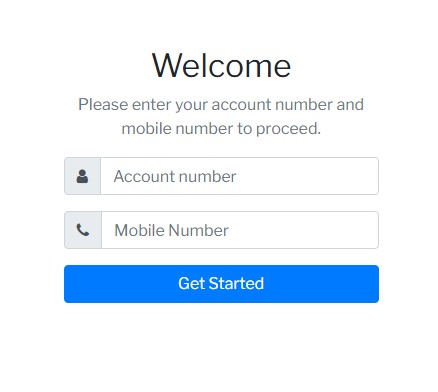

On the next page, click the “Get EZCash Now” button. A page will open for you to provide your Stanbic IBTC account number and mobile number to get started with the loan application. Photo below.

How to Apply Through Their Mobile App

The Stanbic IBTC app champions all the financial services you would love to enjoy from the bank, including loans.

If you are yet to have the app, head over to your store and download it. The app is available for both Android and iOS users.

After downloading the app, log in and locate the “Request EZ Cash” option. Follow the steps and provide all the required information to access your loan.

Alternatively, you can physically visit any nearby Stanbic IBTC Bank branch and apply for your EZ Cash loan.

Also Check: Education Loan in Nigeria: How to Apply & All You Need to Know

How to Repay EZ Cash Loan

Repaying your Stanbic IBTC EZ cash loan is straightforward. As long as the full loan amount is present in your account by the due date, you don’t need to take any additional steps. It’s essentially an automatic process once the funds are available.

Therefore, make sure you have the complete loan amount in your Stanbic IBTC account by the due date.

If you want to repay your loan before the due date, reach out to Stanbic IBTC by sending an email to enterprisedirect@stanbicibtc.com, or call 0700 333 3333.

Alternatively, you can visit any of their branches to make the payment or inquire more.

Roundup

Thank you for following this article to the end, by now, it’s good to conclude that you have understood everything you need to know about this loan and can now navigate and borrow with no stress.

The development of loans has helped us a lot in solving our financial needs and funding our businesses. However, don’t forget to borrow responsibly to maintain a sound financial status.

Additionally, always make sure you go through the terms and conditions of any loan before borrowing. Don’t be lazy! You are accountable for the consequences of your actions, so make sure you thoroughly conduct your research before hitting the borrow button.

To serve you with up-to-date information, we will be updating this page in response to any changes concerning this topic. So, don’t forget to bookmark it for easy access in the future.

Do you have anything to say about this? Please use the comment section below!

Source: Instantmoni.com.

Pingback: Kanono Loans Zambia: What You Should Know And How to Apply - Instant Moni