Do you want to get a credit card in Nigeria? Are you searching to know more about credit cards in Nigeria? If your answer to any of the questions is yes, you are in the right place!

Getting a credit card in Nigeria can be pretty handy for everyday life. It lets you pay for things, borrow money for a short time, and shop both online and in physical stores, even if you’re a bit short on cash at the moment.

In this article, we will explore the credit card, discussing what it’s all about, how you can get it, its limitations in Nigeria, and other important things you would love to know about the card.

We kindly advise you to read to the end so that you will not miss any important information concerning this!

Introduction to Credit Cards in Nigeria: What is a Credit Card?

A credit card, typically issued by banks, is a type of payment card that allows you to buy goods or services or withdraw money just like a regular card, even when you don’t have funds in your account

Here is what makes it different from other cards (such as the debit card, prepaid card, etc.): instead of using your own money, you’re essentially borrowing from the bank. This means you have to pay it back later, along with any interest you accrue.

In Nigeria, the development of credit cards started a very long time ago. This was introduced to make payment more flexible and to give users access to funds at all times in a convenient way.

I call it a “sweet indirect way of borrowing money.” That sounds funny, right? It’s because ever since I acquired my credit card, I have been enjoying easy access to cash, even when I am financially down. No need to go around looking for short-term loans again.

However, there is a low rate of credit card adoption in Nigeria compared to other countries. This is due to several factors such as limited financial inclusion, infrastructure challenges, limited financial literacy, and other bank-related factors.

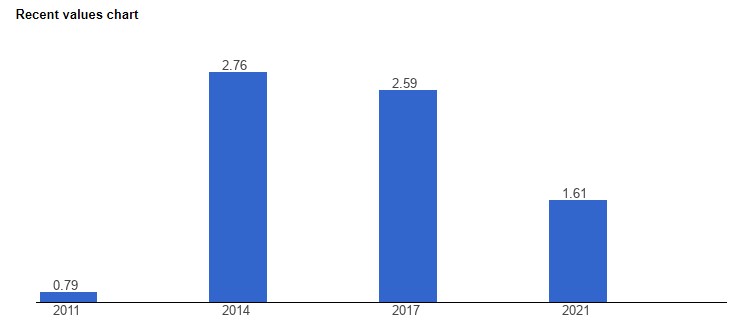

According to The Global Economy, the average value of people with credit cards in Nigeria from 2011 to 2021 is 1.94 percent. The minimum value recorded was 0.79 percent in 2011, while the maximum value was 2.76 percent in 2014, and the most recent value available is from 2021, which is 1.61 percent.

Do You Know?

- We offer expert financial advisor services that can help you achieve your goals.

- We help individuals gain financial freedom.

- We mentor individuals to become successful entrepreneurs.

- We coach or mentor individuals in various digital skills (such as Cybersecurity, Web Design and Development, content creation, Mobile App Development, Data Analysis and Data Science, Digital Marketing, etc).

The comparison of Nigeria’s value with the global average for 2021 is 22.26 percent, based on data from 121 countries.

Read also: A Must Check: Full List of Loan Apps Approved by CBN & FCCPC

Types of Credit Cards Available in Nigeria

There are several types of credit cards available in Nigeria. Each has its unique features or functions.

Note that there is no general or single card that covers all the functions credit cards can offer in one package. Some cards may combine multiple features to provide a comprehensive set of benefits. However, the availability of such cards and their specific features can vary by country and financial institution.

So if you want to get a credit card in Nigeria, make sure you go for a type that matches your needs or expectations.

Without wasting match time, below are the types of credit cards available in Nigeria:

1. Standard Credit Cards

These are basic credit cards that allow users to make purchases up to a predetermined credit limit and repay the borrowed amount over time.

2. Gold and Platinum Credit Cards

These cards often come with higher credit limits and additional perks such as travel insurance, concierge services, and rewards programs.

3. Business Credit Cards

Designed for business owners and entrepreneurs, these cards offer features tailored to business needs, including expense tracking, employee cards, and business rewards programs.

4. Secured Credit Cards

Secured credit cards require a security deposit, typically equal to the credit limit, which serves as collateral for the card. These cards are often easier to obtain for individuals with limited credit history or poor credit scores.

5. Co-branded Credit Cards

Co-branded credit cards are issued in partnership with retailers, airlines, or other businesses. They often offer rewards and discounts specific to the partnering brand.

6. Student Credit Cards

Student credit cards are designed for college or university students. They may have lower credit limits and tailored features to help students build credit responsibly.

7. Low-Interest Credit Cards

These cards offer lower interest rates on outstanding balances, making them suitable for individuals who anticipate carrying a balance from month to month.

8. Travel Rewards Credit Cards

These cards offer travel-related perks such as airline miles, hotel discounts, airport lounge access, and travel insurance coverage.

Read Also: Loans For Startup Business in Nigeria: How to Apply & More

Benefits and Drawbacks of Using Credit Cards in Nigeria

Using a credit card in Nigeria is cool, but at the same time, it has some drawbacks. That being said, every rose has its thorn!

If you intend to use a credit card in Nigeria, knowing its merits and demerits will guide you to a safer side and of course help you to make good use of it. Remember, forewarned is forearmed.

For this reason, let’s share with you the benefits and drawbacks of using credit cards in Nigeria.

Benefits

- Convenience: Credit cards provide a handy way of making purchases without carrying large amounts of money. They are broadly accepted at various merchants, be it online or offline.

- Financial Flexibility: With your credit card, you can make purchases even when you do not have enough cash in your bank account. This can be a handy option, especially when you are hit with a sudden or expected financial challenge.

- Building Credit History: Responsible use of a credit card can help you establish and build your credit history. Timely payments and maintaining a low credit score usage ratio can improve your credit score, making it simpler to qualify for loans and different financial products in the future.

- Rewards and Perks: Many credit cards offer rewards programs, cashback incentives, and other perks for cardholders. These rewards include airline miles, hotel discounts, cash rebates, etc.

Drawbacks

- You are likely to overspend when you have a credit card. This is a common challenge for people with poor financial management or self-discipline. When you are spending without a budget, you are likely to accumulate debt which will become so difficult for you to repay.

- You can also incur high-interest rates when you fail to clear your credit card debt from month to month. This and other related fees and penalties can damage your credit score.

- Credit card fraud and identity theft are another prominent drawbacks associated with using a credit card. If not handled carefully can result in financial losses and inconvenience for cardholders.

Is it possible to get a credit card in Nigeria?

Yes, it’s possible to get a credit card in Nigeria! Almost all the domestic banks in Nigeria offer credit cards. A few to mention are UBA, Standard Chartered plc, First Bank of Nigeria Limited, GTBank, Sterling Bank, and Stanbic IBTC Bank, among others. You can visit your preferred bank to request yours provided you meet the eligibility requirements.

Read Also: Car Loan in Lagos: Get Your Dream Car Today

Eligibility Criteria for Obtaining a Credit Card in Nigeria.

To obtain a credit card in Nigeria, there are certain eligibility requirements you must meet. However, these criteria vary among providers.

Nevertheless, here’s a general overview of the key requirements you’ll typically need to meet to obtain a credit card in Nigeria:

- Applicants must be between the ages of 18 and 57.

- You must meet the minimum income level requirement set by the financial institution you intend to obtain your credit card.

- You must be employed or have a stable source of income to qualify for a credit card.

- Applicants must be Nigerian citizens or legal residents of the country.

- It would be best if you have good credit scores. This will increase your chances of getting approval.

- Applicants must not have any adverse Credit Bureau or CRMS report.

- You must have an active bank account with the financial institution you intend to obtain the card from.

How to Get a Credit Card in Nigeria

Getting a credit card in Nigeria can be hassle-free once you meet the eligibility requirements. You can follow the simple steps below to get yours:

- Visit your preferred bank or financial institution.

- Choose the right card for you.

- Complete the credit card application form.

- Wait for approval.

- Receive and activate your card (if approved).

- Read and understand the terms and conditions of the card.

- Start using your credit card responsibly.

Final Thoughts

Thanks for following this article to the end! I believe that by now you have understood everything you need to know about credit cards in Nigeria and can successfully get yours with no stress.

I may love to add that, while credit cards offer convenient access to funds, remember: it’s not free money—it’s a debt you’ll need to settle along with any interest you accrue! So, don’t forget to use it responsibly to avoid accumulating debt that will become difficult for you to repay.

To serve you with up-to-date information, we will be updating this page in response to any changes concerning credit cards in Nigeria. So, don’t forget to bookmark it for easy access in the future.

Do you have a question or an opinion concerning this topic? Don’t forget to use the comment section below!

Source: Instantmoni.com.

Pingback: Loan Apps in Nigeria: Compare, Choose, and Apply - Instant Moni

Pingback: Top 8 Loan Apps Without BVN in Nigeria - Instant Moni

Pingback: 7 Best Savings Apps in Nigeria You Will Love - Instant Moni

Pingback: Real Estate Investment in Nigeria: How to Invest And More | INSTANTMONI